January 27, 2005

Student needs in the classroom

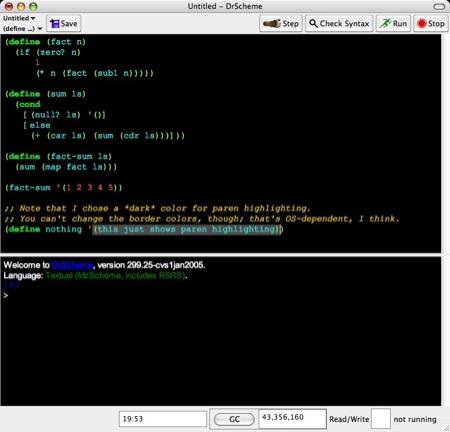

Recently on the PLT Scheme mailing list, a question came up regarding the DrScheme editor pane and students with particular vision needs. Students with vision difficulties often increase text size and reverse colors for higher contrast; the question was whether or not this was possible in DrScheme.

The answer is that yes, in the currently-beta-but-usable-and-soon-to-be-released version, it is possible to completely invert the colors.

As pedagogic IDEs take their place in the classroom (as opposed to introducing students to programming using a professional environments like Eclipse, or with no support at all, like the command line), it will become more important that these kinds of needs are addressed.

(Alas, there is an error in the Scheme code above. Had it followed the methodology laid out in How to Design Programs, the mistake might have been avoided!)

Posted by mjadud at 11:51 AM | Comments (0)

January 13, 2005

Programming for the Blind

Recently asked on the SIGCSE mailing list was about tools for supporting blind programmers (students). A few things came to light that are worth mentioning; if anything else should be added, please let us know.

In no particular order:

- The new Mac OSX (10.4) has "screen reading" built into the OS. That is, out-of-the-box, it should provide a rich spoken interface. Called VoiceOver, we don't have any first-hand experience with it at this time.

- Silias Brown has a webpage with some good resources; he is partially sighted himself.

- JAWS was mentioned more than once; a Windows-based solution.

- The work of Gary Bishop at UNC Chapel Hill was mentioned.

- Lambda the Ultimate had a live thread on a similar topic at the same time the question was asked. In that thread, a pointer to the Harmonia project at Berkely was made. "Programming by Voice" is perhaps a quick summary, but this is a rich project that can't be captured in just a few words; take a look.

- Dasher was discussed as well, but someone would need to develop either A) a language model that worked for programming, or B) a yacc-like language model that supported all languages. Currently, Dasher is only an n-gram based model that predicts n-gram+1.

Posted by mjadud at 03:19 AM | Comments (0)